With the great feedback we received on our DFW market updates, we’re adding specific information on Houston this week and Austin next. Per CoStar, Houston is globally known as an energy headquarters and will continue benefiting from this status, as many talented workers are located in the area. Nearly 255 of Houston’s office inventory comprises energy tenants, which is an outlier among other U.S. metros but is similar to the space percentages by tech tenants in cities such as San Francisco and Austin or finance tenants in metros such as New York and Charlotte. Unfortunately, the recent slide in oil prices is a stark reminder of the risks of relying on a single industries such as these cities mentioned here.

With the great feedback we received on our DFW market updates, we’re adding specific information on Houston this week and Austin next. Per CoStar, Houston is globally known as an energy headquarters and will continue benefiting from this status, as many talented workers are located in the area. Nearly 255 of Houston’s office inventory comprises energy tenants, which is an outlier among other U.S. metros but is similar to the space percentages by tech tenants in cities such as San Francisco and Austin or finance tenants in metros such as New York and Charlotte. Unfortunately, the recent slide in oil prices is a stark reminder of the risks of relying on a single industries such as these cities mentioned here.

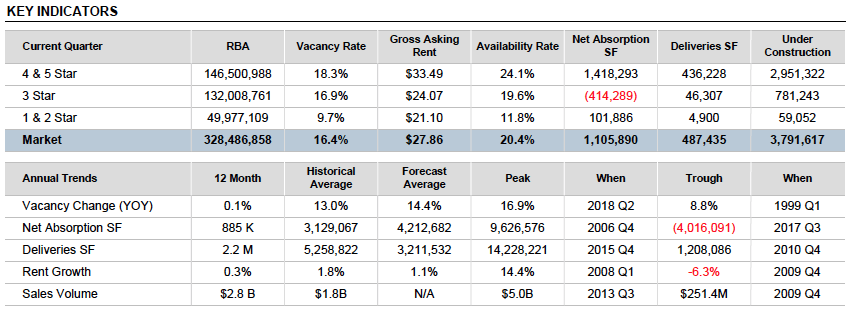

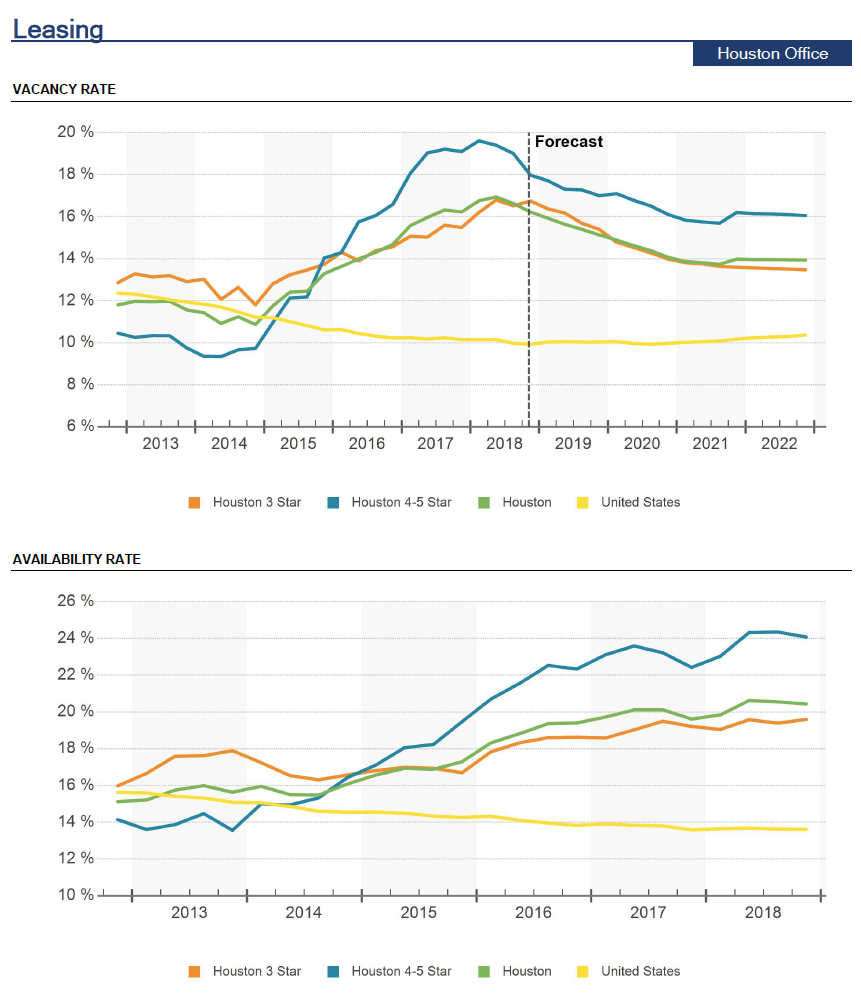

The reality of Houston’s office market is that it has endured three consecutive years of lagging fundamentals. Now into the third quarter of 2018, a fourth year of softness is fast becoming a reality, Houston’s office market remains in tough shape, with sluggish leasing demand, elevated levels of sublease space (although declining) and a stubbornly high vacancy rate. With a slowing supply pipeline and an improving labor market, the outlook for the office market continues to improve. However, it remains to be seen when these increasing job numbers may translate to heightened leasing demand, a trend that unfortunately remains elusive.

Leasing

CoStar reports on the Shale Revolution that occurred during the early part of the decade and in the wake of the Great Recession. The advent of hydraulic fracturing (fracking) technology and technological advances in general created this Shale Revolution in the U.S., reversing declining domestic oil production for the first time since the 1970s. So successful in adoption, U.S. Shale created a New Oil Order, reinstating the U.S. as one of the world’s top three oil and gas producers, which generated a nearly unprecedented economic boom in Houston.

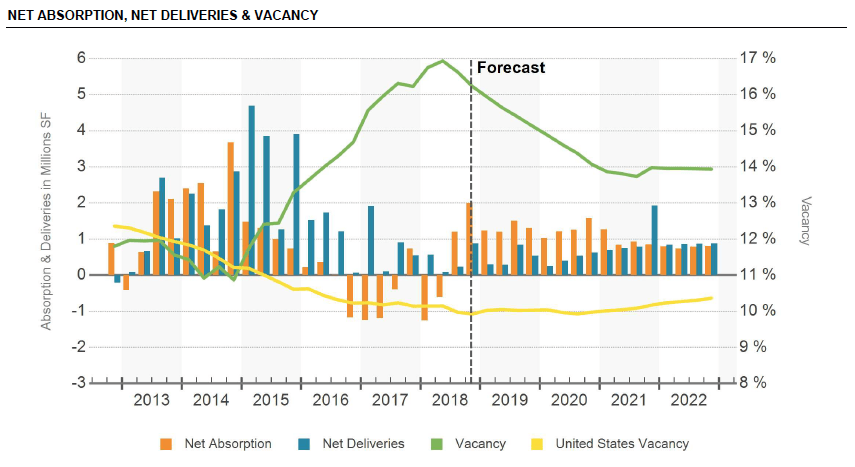

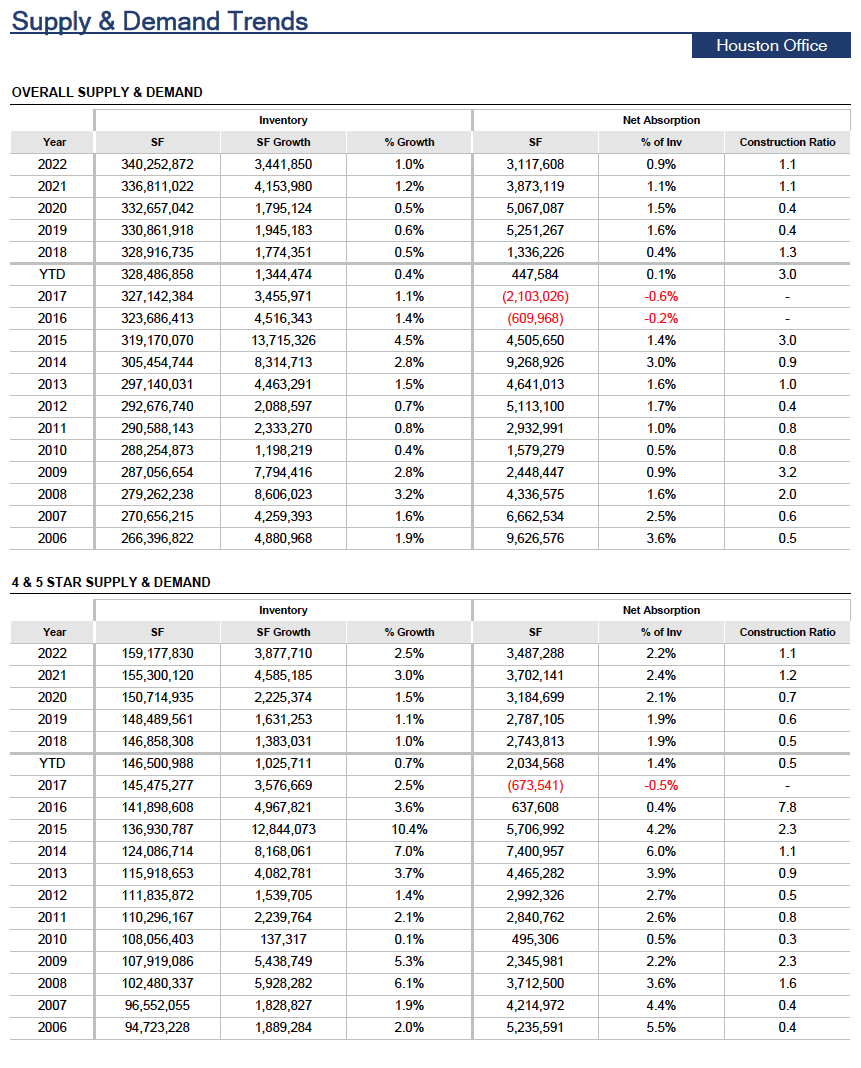

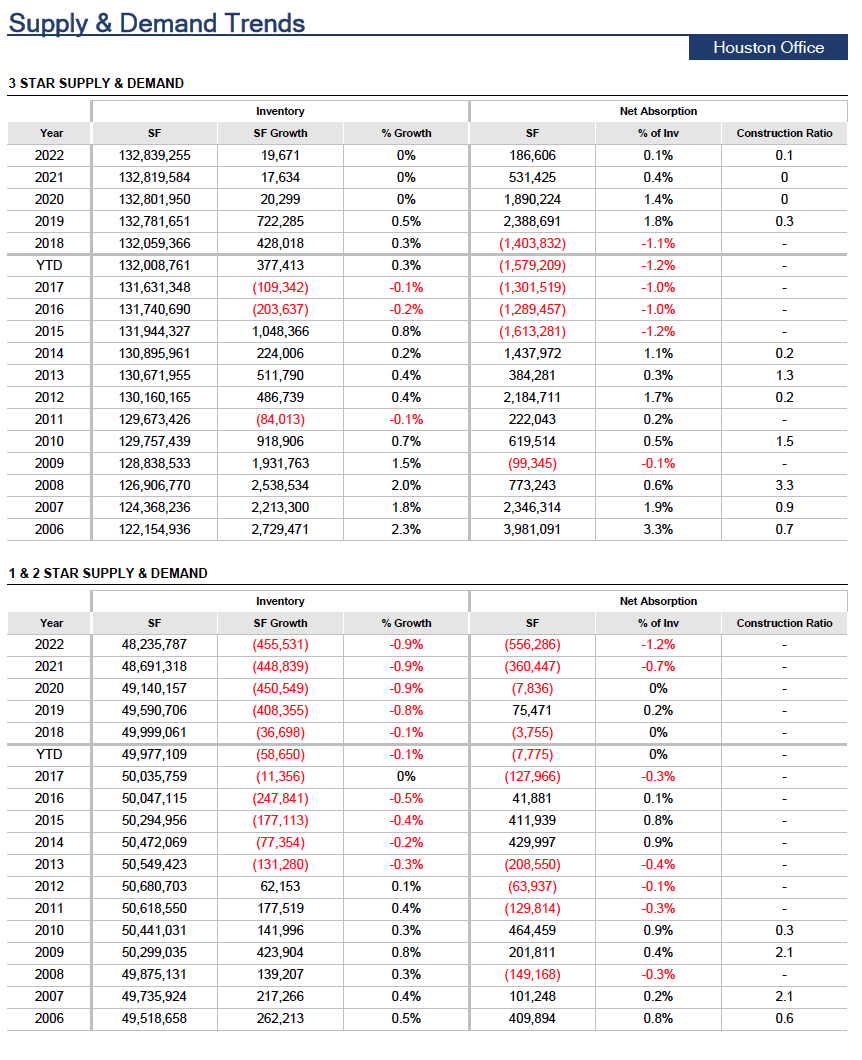

In turn, the metro was regularly adding more than 100,000 jobs per year, and many of the metro’s largest employers were increasing their employee count and footprints within Houston. This sparked significant speculative office construction, and no metro has added more office space this cycle than Houston. However, just as things were going well, a rapid decline in crude oil prices had energy companies reeling. The global energy industry was a victim of its own success and experienced a massive correction not seen since the 1980s. Many of those same oil companies—which had been leasing space defensively—reversed course and began to resize their operations or fold.

Demand has been in a free fall since mid-2015, which coincides with more than 18 million SF of office deliveries since then. A significant portion of that space remains empty, particularly because demand has been negative in five out of the past six quarters. As of 18Q3, office vacancies in Houston now rank highest among the top 54 U.S. metros. Dallas, Northern New Jersey, Washington D.C. and Phoenix round out the top five.

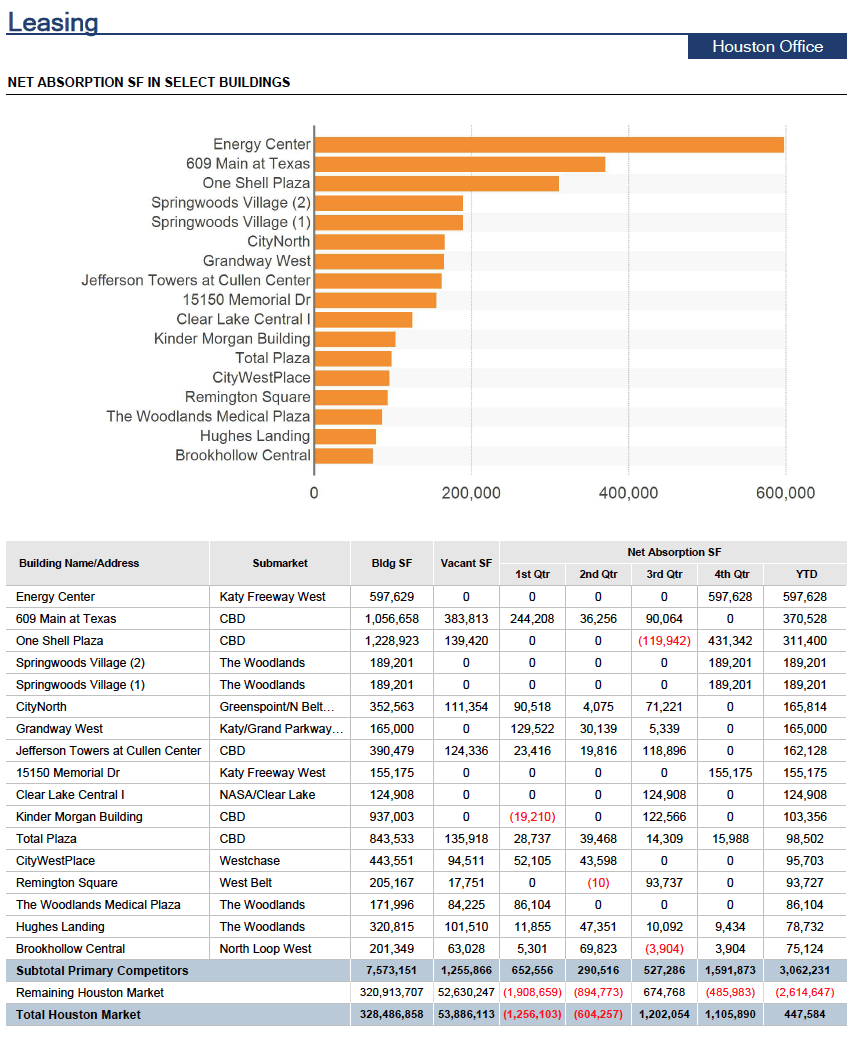

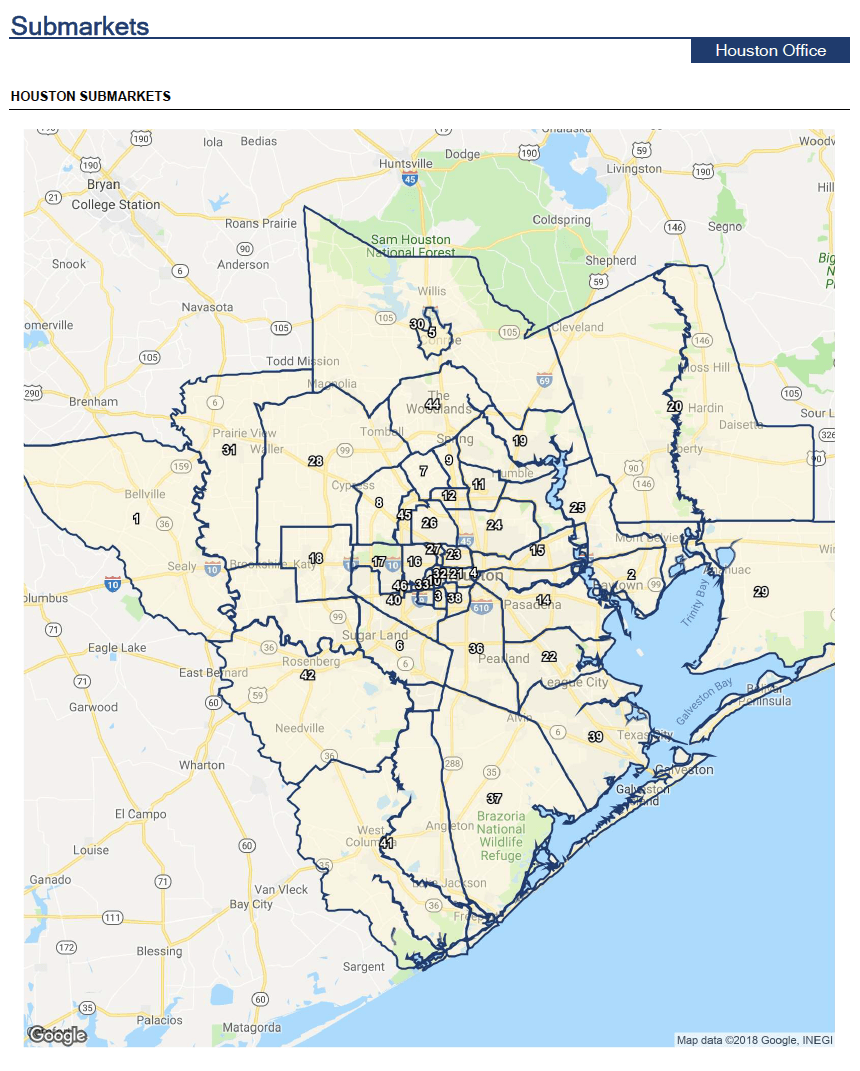

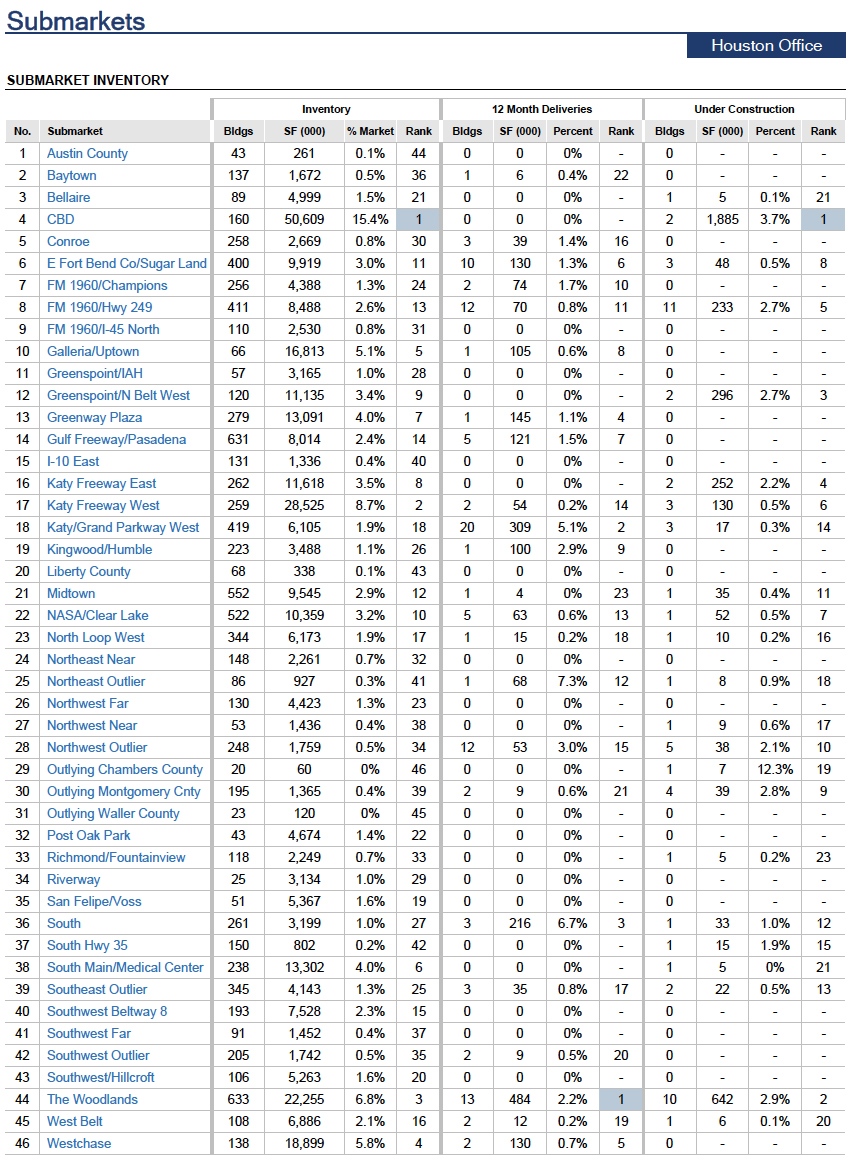

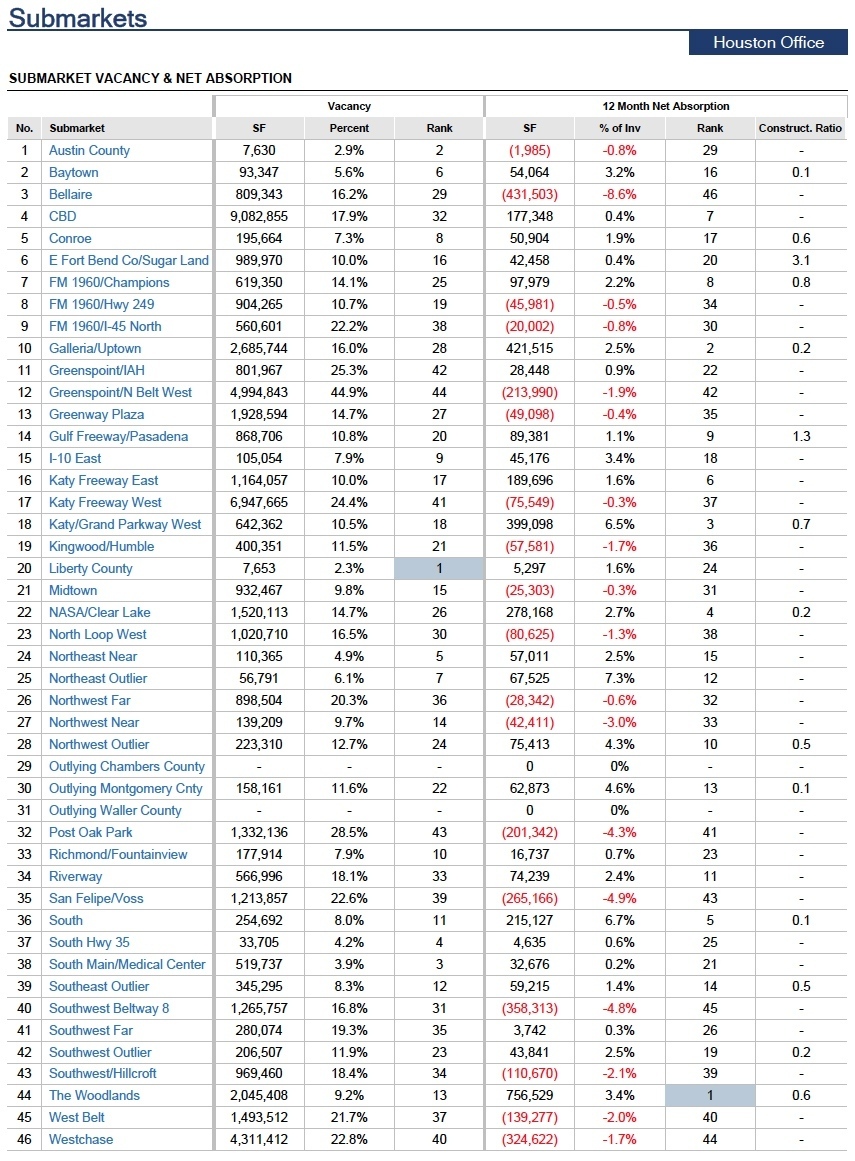

Suburban submarkets have attracted the most demand this cycle, which is similar to the trend seen by some of the hottest U.S. office markets such as Dallas-Fort Worth and San Jose. Among those suburban submarkets, The Woodlands saw the lion’s share of net absorption, mostly thanks to the new ExxonMobil campus in Springwoods Village. This campus alone makes up a little less than half of the nearly 10 million SF absorbed since 2010. Over in the Energy Corridor, Katy Freeway West has seen more than 4 million SF of absorption, which is impressive given its plethora of energy-related firms that have downsized this cycle. And in the CBD—which actually experienced negative net absorption this cycle as tenants flocked to suburban space—a flight to quality to 4 & 5 Star space was its major saving grace. In other institutional submarkets such as Galleria/Uptown and Westchase, net absorption would have been negative if not for a flight to quality to mostly 4 & 5 Star space.

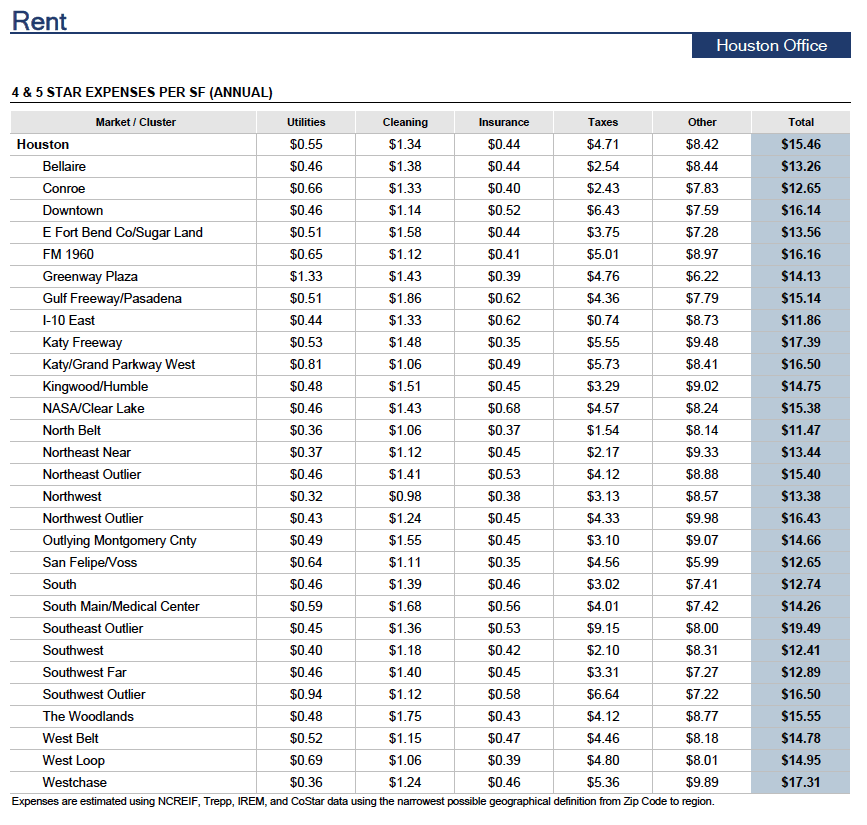

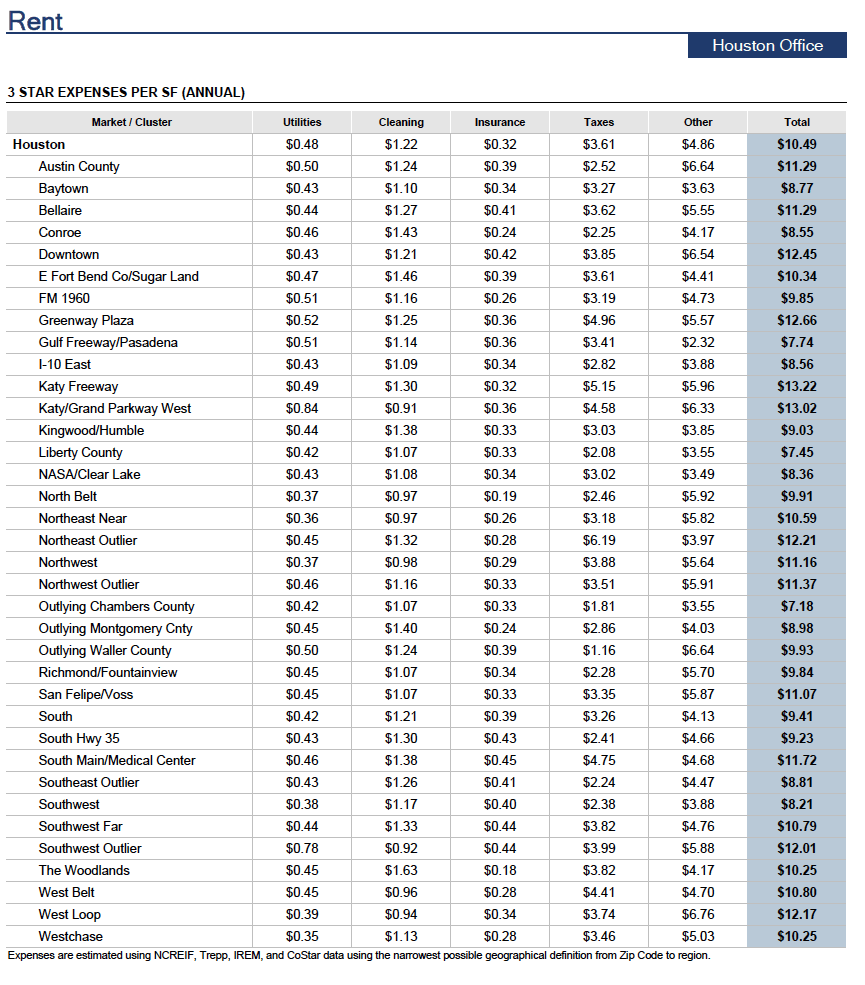

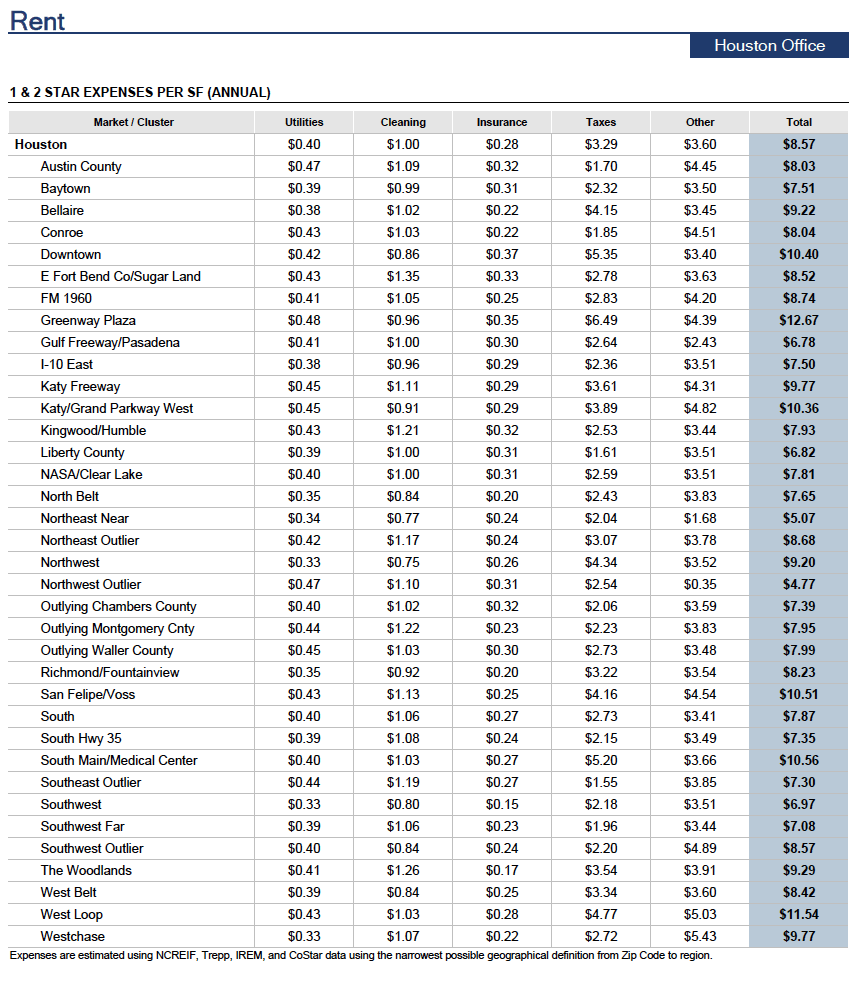

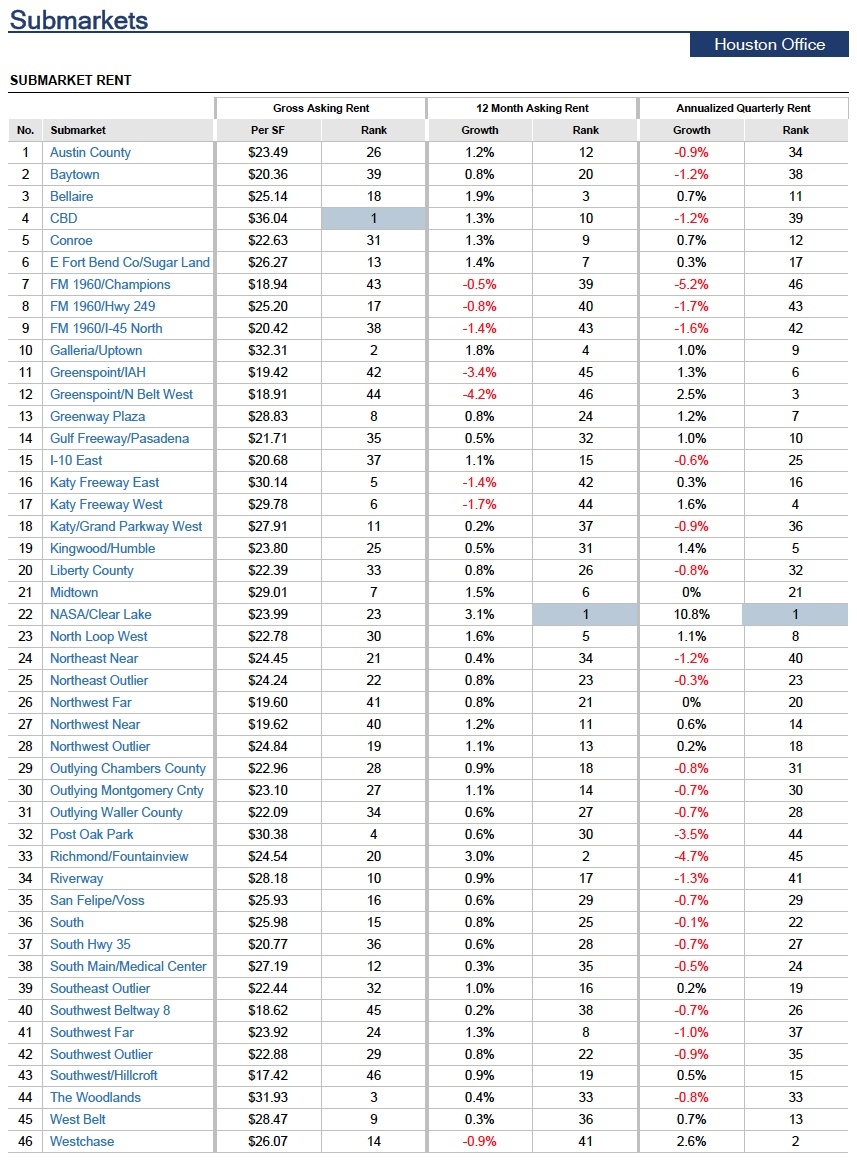

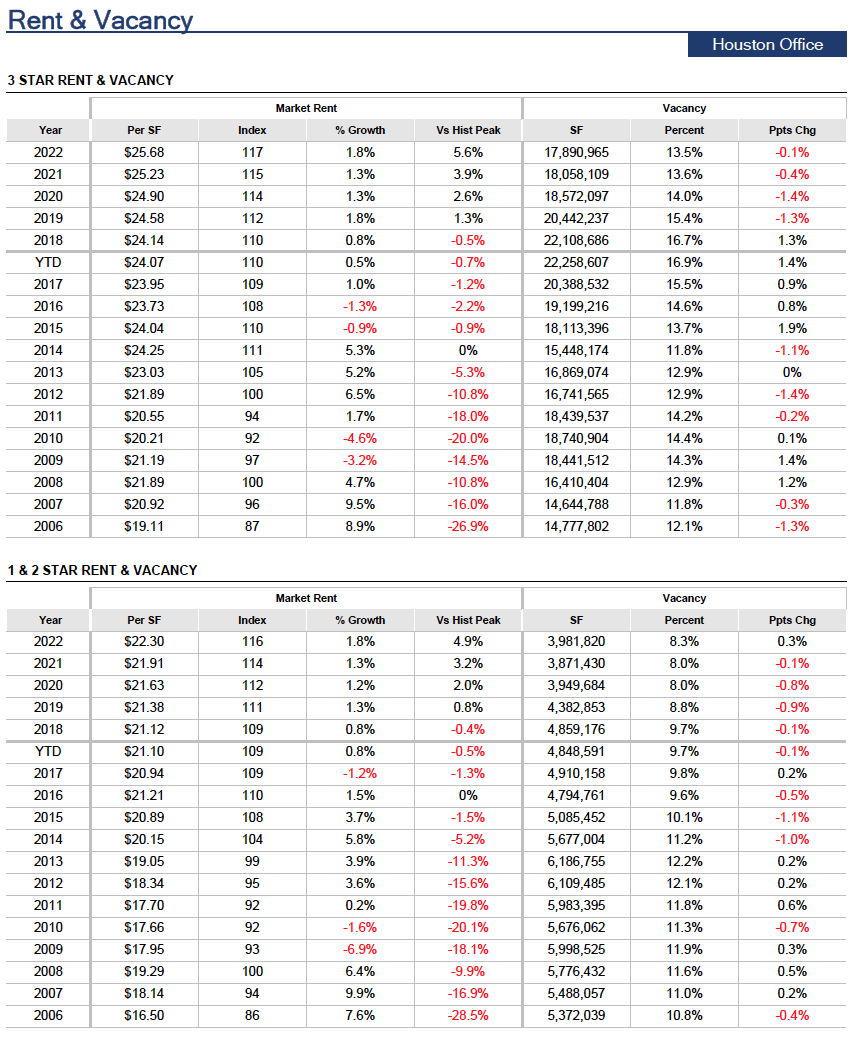

Rent

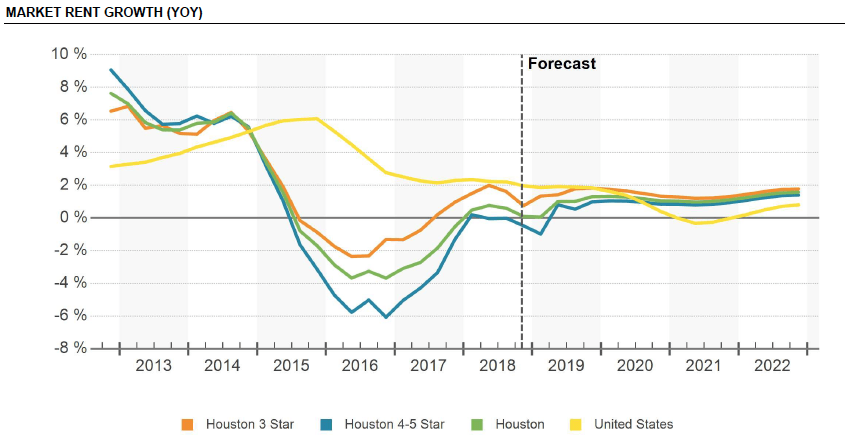

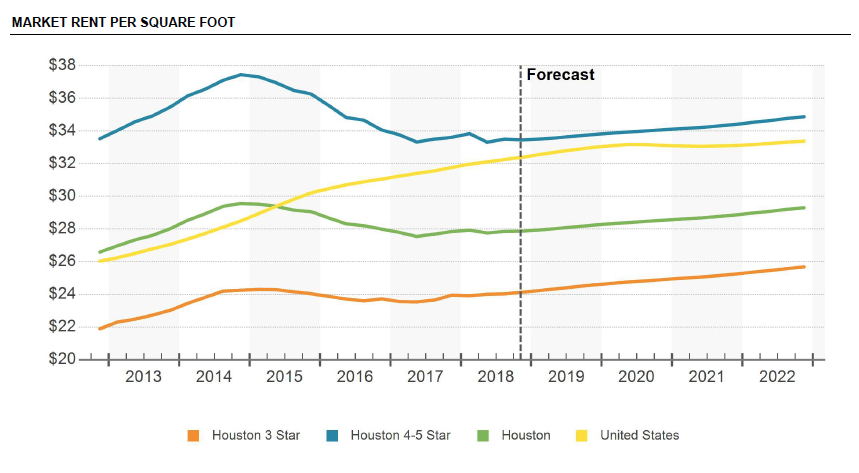

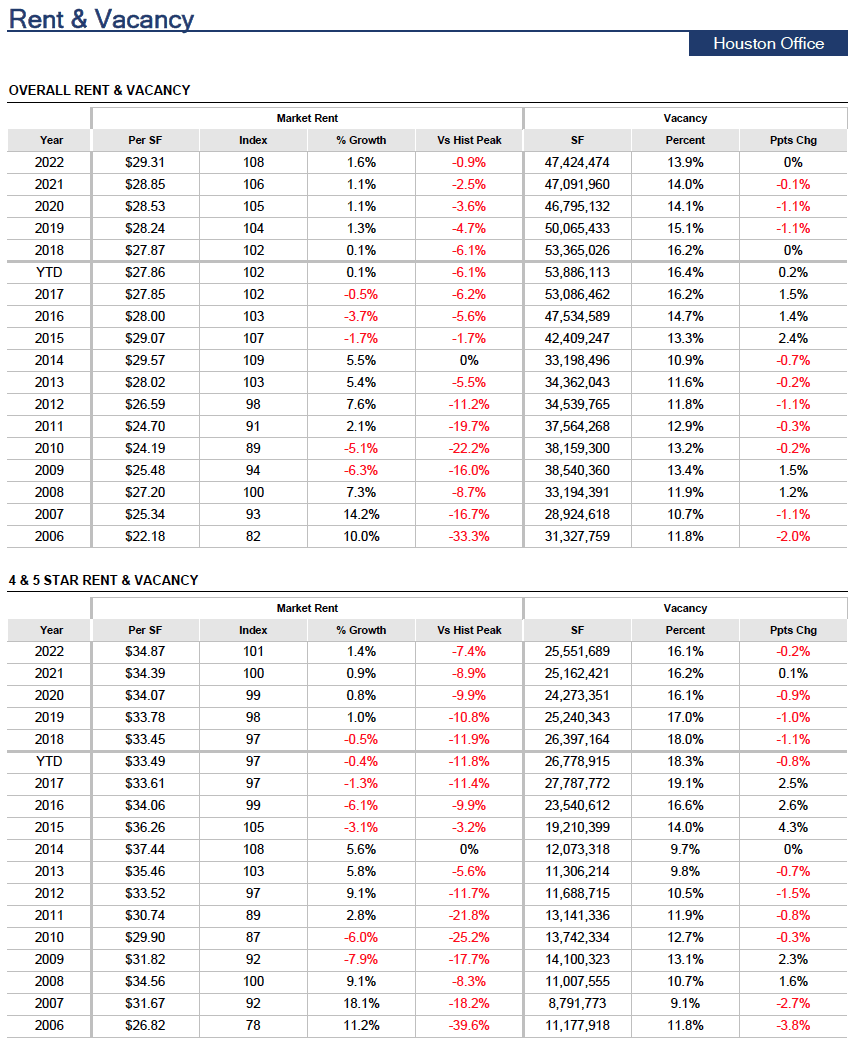

Trailing 12-month rent growth in Houston was negative for 10 straight quarters, between 15Q3 and 17Q4. Although this may sound alarming, the Great Recession similarly triggered nine straight quarters of negative rent growth between years 2009 and 2011, indicative of the importance of the health of the greater U.S. economy on Houston’s local economy. Although the outlook for Houston’s office market remains bearish, there are some positive green shoots. Net absorption turned positive in both 18Q2 and 18Q3, and as a result, four-quarter trailing rent growth was slightly positive in both of those quarters. But, given the amount of office space still under construction and grim demand prospects, anything above a modest level of growth may still be a few years away.

Soft rent growth prospects in Houston’s office market are a recent development. Between 2010 and 2014, Houston ranked fifth alongside some of the fastest-growing cities in terms of cumulative rent growth—among cities like San Francisco, San Jose, New York, Austin, Denver and Boston. The significant slowdown in rent growth over the past three years has diluted the success of the earlier years, and average annual rent growth in Houston this cycle barely eclipses 1%, which trails the metro’s historical average.

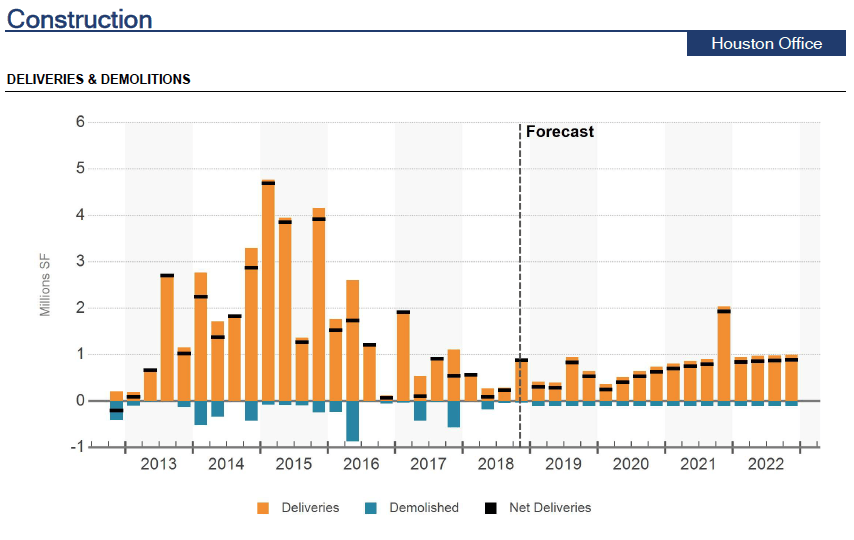

Construction

Houston is only metro in the entire U.S. that, on a net basis, has delivered more than 40 million SF this cycle. Dallas-Fort Worthis the only other metro that has delivered more than 30 million SF. Between 2010 and 2017, supply additions averaged about 5 million SF per year, with the high mark set at more than 13 million SF in 2015.

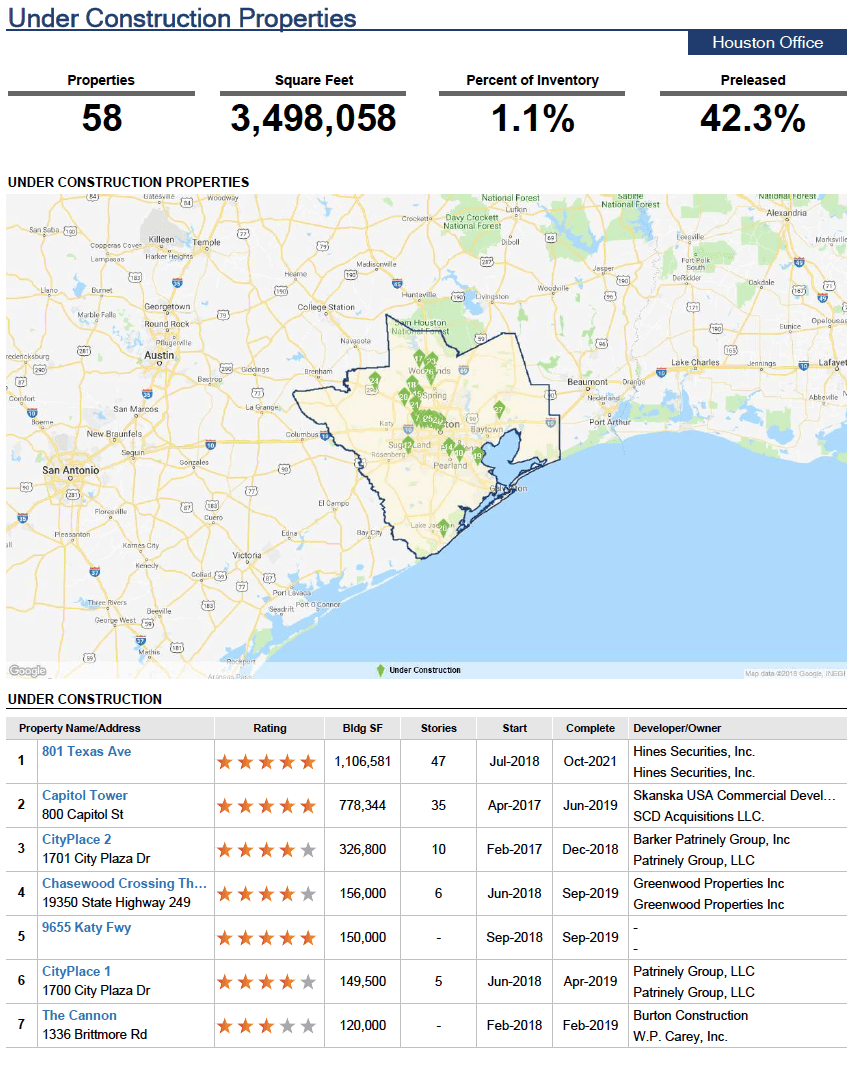

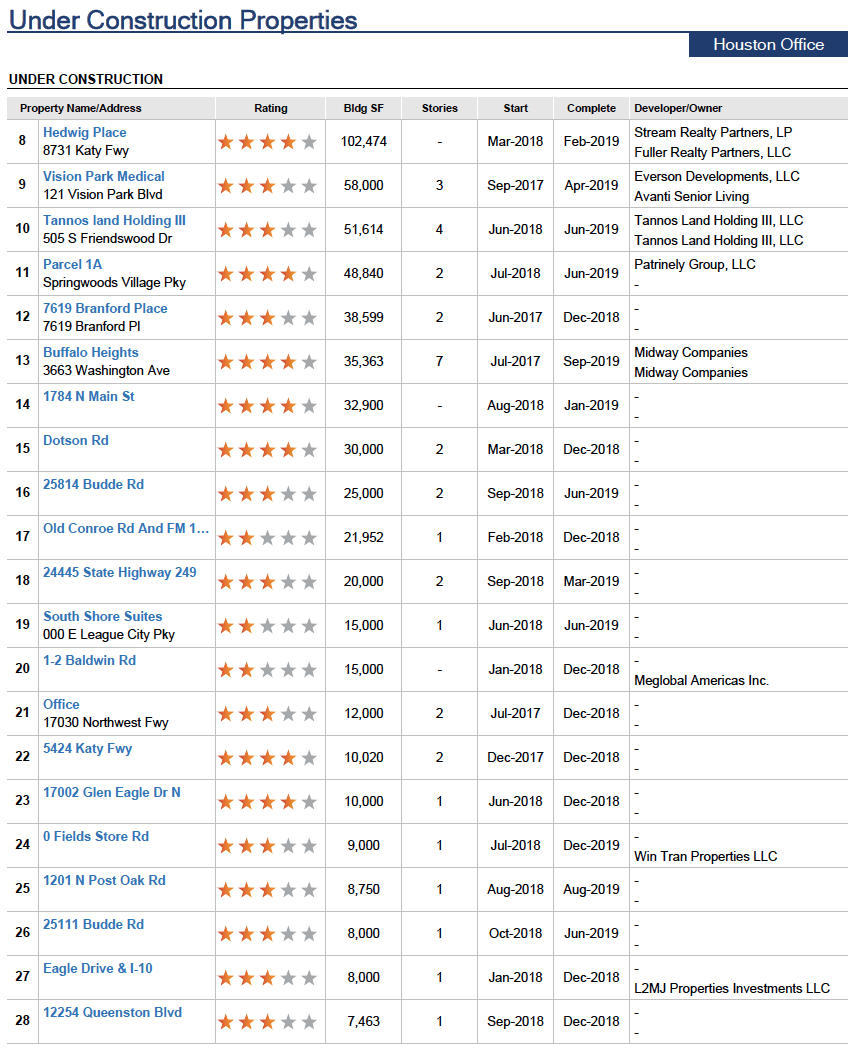

The development cycle has finally begun to slow and could provide the relief that the office market has needed. Most of the submarkets that received the largest supply increase over the past few years hold the remaining balance of construction. The Woodlands delivered more than 10 million SF this cycle and had another 900,000 SF under construction as of 18Q3. Similar to The Woodlands, the CBD delivered about 3.4 million SF and now has about 1.9 million SF under construction via the Capitol Tower and 801 Texas Ave., Hines’ newest project.

The CBD and the Energy Corridor dominated headlines and activity this cycle. A lot of the buzz in Houston’s CBD began with 609 Main, a 1-million-SF office tower developed by Hines that delivered in 17Q1. The building was about 65% leased as of 18Q3, with noteworthy law firm tenants taking 200,000 SF and United Airlines taking just shy of 240,000 SF.

Next came the announcement from Skanska that construction would continue on Capitol Tower, the highly talked-about, 778,000-SF tower that Skanska built a parking garage for then halted construction on as it waited for more tenant commitments. The signing of Bank of America certainly helped, but Skanska reportedly attributed the green light to the “optimism that the marketplace will present new opportunities for the project as we move through 2017.”

More recently, Hines announced in July 2018 that it would continue its foray into the CBD via another trophy tower. In October 2015, Hines acquired the former Houston Chronicle site, with plans to develop both office and multifamily assets. After demolishing the prior office building on site, Hines waited a few years and announced its intentions to move forward with its third downtown office asset this cycle. Once completed in late 2021, 801 Texas Ave. will house just over 1 million SF of high-quality office space. In fact, nearly one-third of the building has been leased to Vinson & Elkins (212,000 SF) and Hines (155,000 SF), which will both relocate from their existing offices in the CBD and Galleria, respectively, upon completion.

The Energy Corridor has experienced tremendous growth this cycle. The corridor, which is west of the CBD along I-10, contains the Katy Freeway West and Katy Freeway East Submarkets and more than 40 million SF of office space. The tenant mix in this area of the metro is a who’s who of energy companies: Shell, BP and ConocoPhillips—to name a few. Due to the Energy Corridor’s reliance on oil, West Houston ramped up construction during the boom, and fundamentals during the oil downturn softened significantly. Since late-2016, vacancies have remained above 20% in Katy Freeway West, the larger of the two submarkets, with a few new deliveries completely empty.

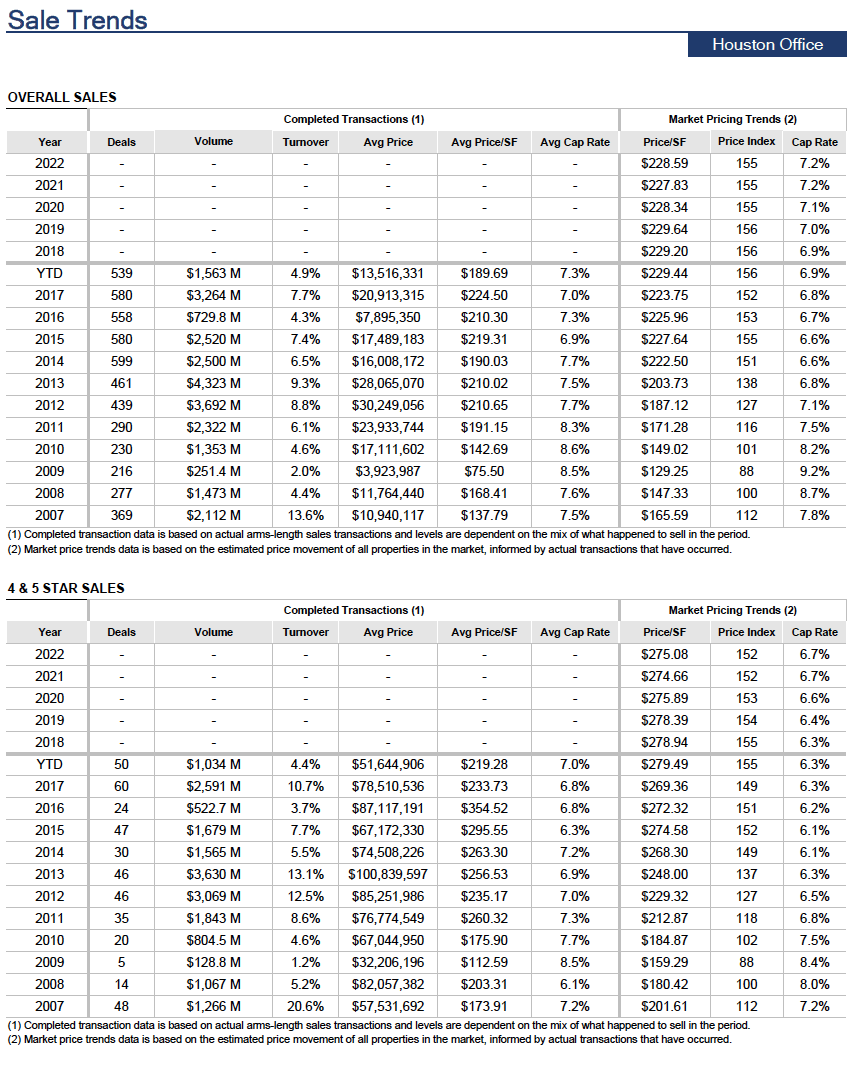

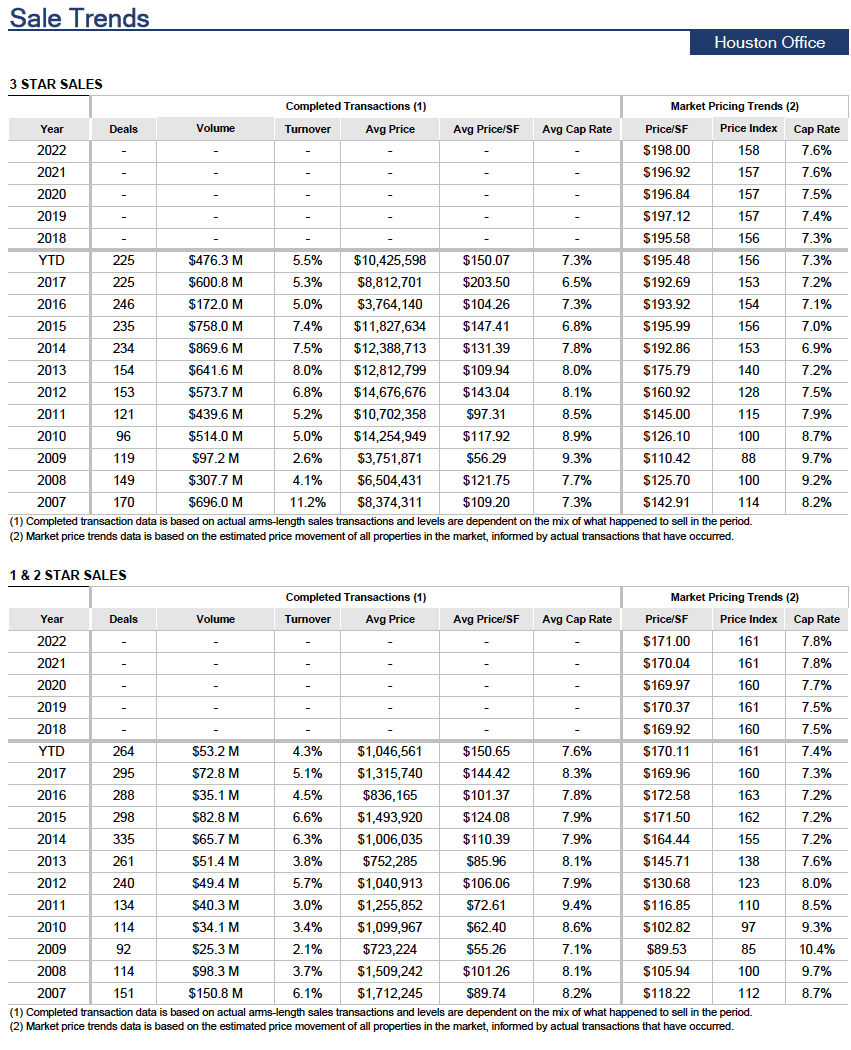

Sales

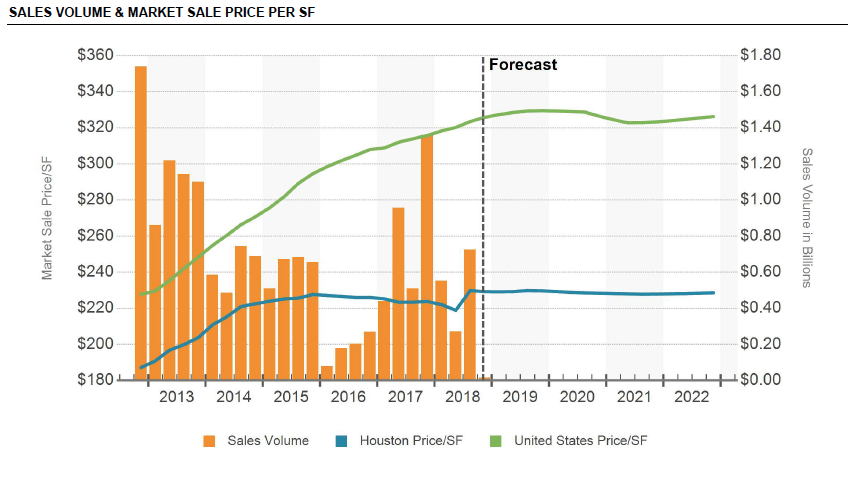

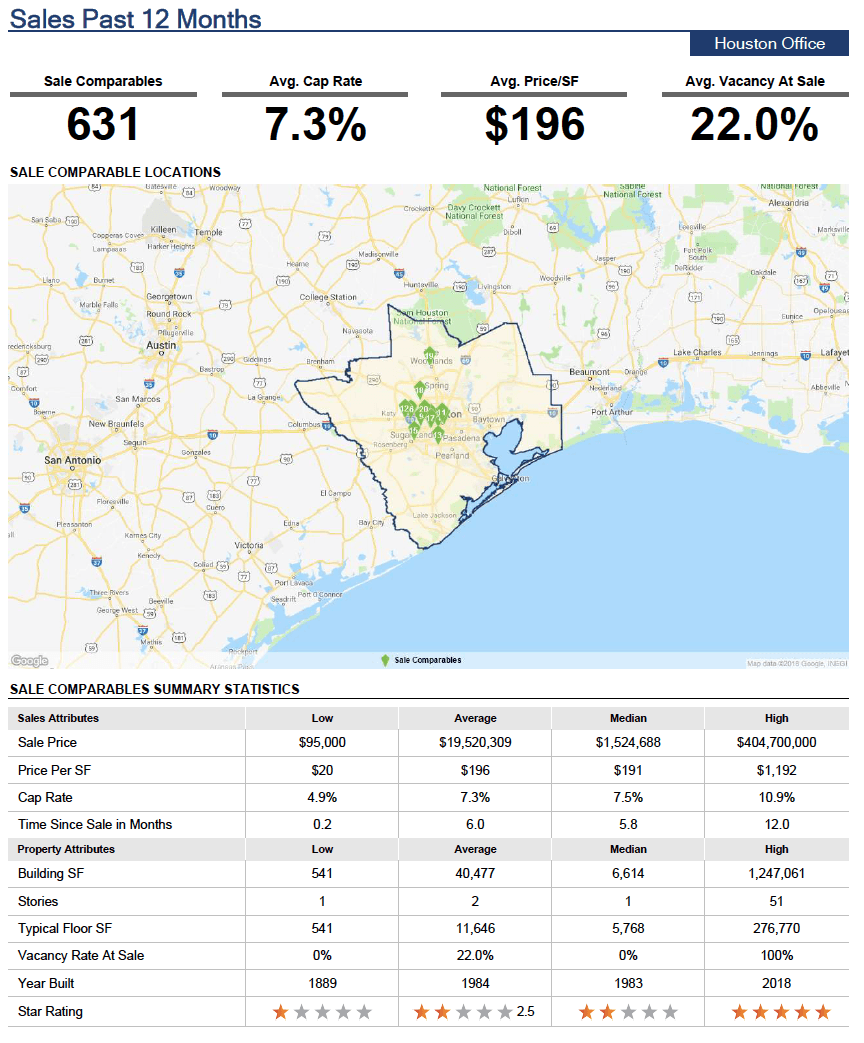

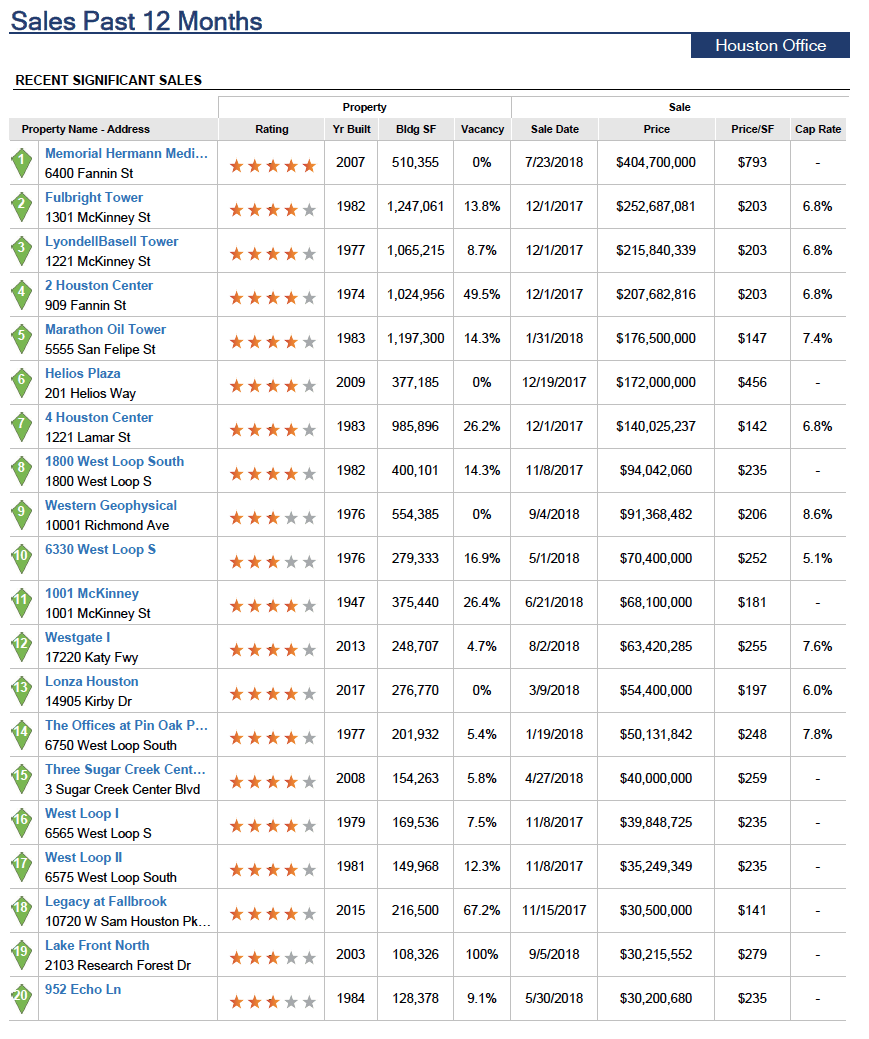

CoStar explains Houston’s past investment activity as a market thatwas quick to recover after the recession, with inventory turnover that rapidly picked up. Between 2010 and 2015, the market averaged about 7% turnover annually. Most of these sales took place during the run-up of oil prices and the growing expansion of Houston’s office market in 2012—14. Following this buying frenzy in the early part of the decade, Houston experienced a pullback in investment activity, trading just 4% of inventory in 2016, levels not seen since the 2008–09 recession. However, investors made their way back to Houston in 2017, as turnover amounted to nearly 8%, a large portion of which was attributed Canada Pension Plan Investment Board’s acquisition of Parkway and JP Morgan’s sale of Houston Center to Brookfield.

Houston was the only major U.S. metro to experience a correction since the Global Financial Crisis, and this drew investors to the metro, seeking low basis and yield in one of the world’s preeminent economies. At the same time, the rest of the U.S. was experiencing peak pricing. In early 2017, Spear Street acquired a three-property portfolio from Columbia Property Trust for $272 million. The sale of that portfolio, which consisted of 5 Houston Center, Energy Center I and 515 Post Oak Blvd., marked a turning point; it was the first large transaction during the oil downturn and the largest investment since October 2016, when Cousins Properties and Parkway Properties merged.

Spear Street made another major play in 17Q1, when it acquired the former ExxonMobil property in Greenway Plaza. The acquisition included the six-story, 450,000-SF office building, a 100,000-SF training center, 13 auxiliary buildings and a parking garage. The firm, in partnership with Transwestern, demolished the former ExxonMobil facilities, with plans to develop a mixed-use project on the site. However, according to Spear Street, that may take a while.

In April 2017, Parkway recapitalized the 5-million-SF, 11-property Greenway Plaza portfolio by selling a 49%interest in the properties for $512 million, or an implied$210/SF, to TH Real Estate Global Asset Management (24.5%) and the Canada Pension Plan Investment Board (24.5%).

Interest in the Greenway Plaza was further solidified when Canada Pension Plan Investment Board acquired Parkway in early October. As a result, 19 office properties throughout Houston were acquired by CPPIB for $1.2 billion ($139/SF). The aforementioned 11-property Greenway Plaza and four-property CityWestPlace were among the notable assets involved in the acquisition.

In December 2017, a notable large-scale transaction took place in the CBD as Toronto-based Brookfield Asset Management closed on Houston Center, a 4-million-SF portfolio of four office buildings and one retail building, for $855 million. The office buildings involved include the 1.2-million-SF Fulbright Tower, the 1-million-SF LyondellBasell Tower, the 1-million-SF 2 Houston Center and the 680,000-SF 4 Houston Center. These were valued at approximately $782 million ($195/SF), and collective occupancy across all five properties was about 73% at the time of sale. Both the Parkway and Houston Center acquisitions signified a strong appetite for large-scale value-add portfolios in Houston during a strategic time in the economic cycle.

Houston experienced heightened investment activity in early 2018 via the sale of the Marathon Oil Tower. The 1.2-million-SF property sold in January for $176.5 million ($147/SF). CBRE Global Investors initially acquired the asset in late 2013 for $245.4 million ($205/SF) at the height of the oil boom. However, as the energy sector started to reel and job cuts became a fact of life in West Houston, the L.A.-based investor reportedly began shopping the asset, only to remove it from the market when there was serious interest. Then, in 18Q1, a joint venture between Baupost Group of Boston and M-M Properties of Houston acquired the asset at a 7.4% cap rate. The property was about 87%occupied at the time of sale, although the building’s namesake tenant, Marathon Oil, occupies more than 60% of the building and has a lease expiring in 2021.

More recently, the 5 Star, 510,300-SF Memorial Hermann Medical Medical Plaza traded hands in July 2018 for approximately $405 million ($794/SF), making it the most expensive medical office sale in U.S. history. Locally based Mischer Investments sold the trophy asset to LaSalle Investment Management of Chicago. The property is located within the Texas Medical Center and is anchored by Memorial Hermann, which at the time of sale, occupied more than 60% of the building. Overall, the property was 99% leased at the time of sale.

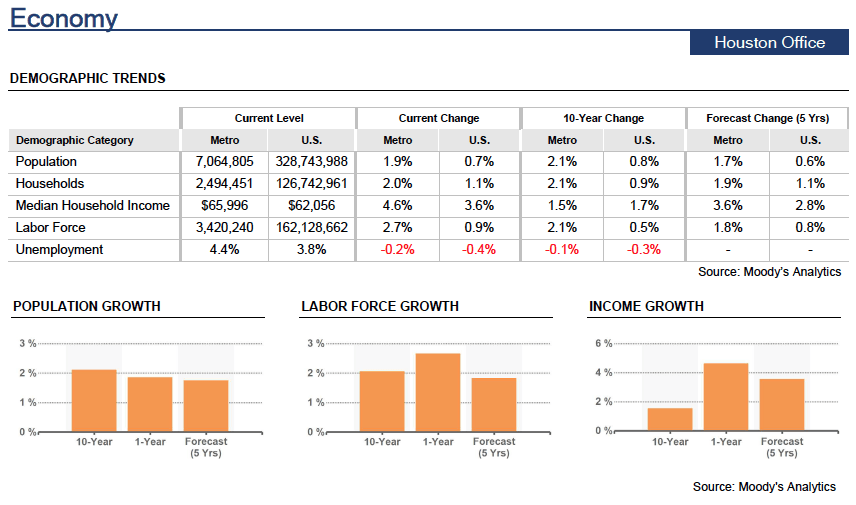

Economy

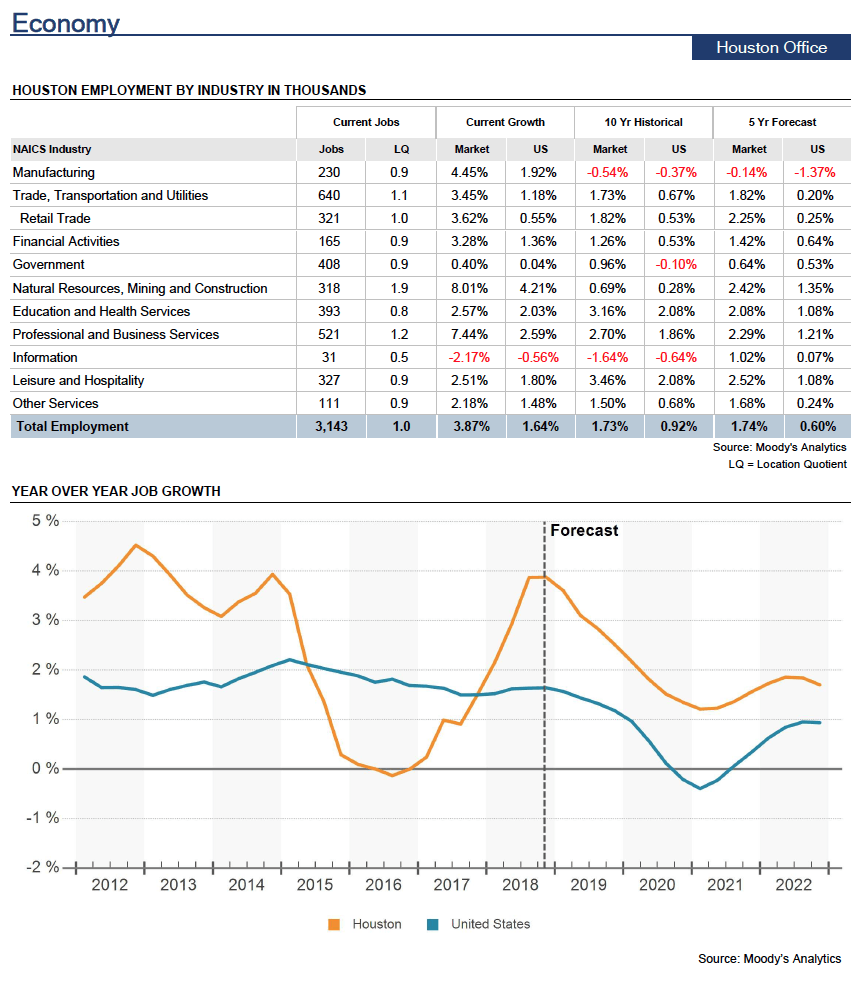

With one of the largest economies in the world, Houston ranks as the fourth-most-populous city and fifth-most-populous metro in the United States. It has more than 6.9 million residents and has grown at an impressive pace recently. If Houston were a nation, it would be the 24th-largest economy in the world and is currently the 7th-largest economy in the U.S. in terms of GDP. TwentyFortune 500 companies call Houston home and helpspur the more than 3 million jobs that exist here. Houston is known as the Energy Capital of the World—owing to its preeminent cluster of energy-related companies that are headquartered in the city. It is also home to the world’s largest health care complex (the Texas Medical Center), the NASA Lyndon B. Johnson Space Center and the nation’s largest U.S. export port.

Houston’s resilience through the Global Financial Crisis, the recent height of the Shale Boom and the oil downturn is supported by its strong demographic trends. Since 2010, its population has grown by more than 15%, equating to over 1 million new residents added. Although nominal growth has slowed in each of the past 3years, Houston still ranked second only to Dallas-Fort Worth among major U.S. metros for population growth over that time frame. This rapid growth is impressive, especially considering the recent local economic downturn and Hurricane Harvey. Through all of this, Houston still remains appealing to new residents due to its affordable cost of living, attractive climate and affordable home prices, among other factors.

Over the past year, Houston has added over 100,000 jobs, returning to a level of job growth not seen since the first quarter of 2015. This follows a year of tepid, below-average job growth in 2017 and 2 slightly negative years of job growth in 2015 and 2016. Part of this turnaround in the local economy owes itself to recovery efforts in the wake of Harvey, although the majority of growth is attributed to a recovery in oil prices and a brighter outlook for energy companies.

These leading economic indicators demonstrate a strong and lasting economy; however, Houston’s dependency on the energy industry continues to cast a dark shadow on the overall real estate market. The recent oil crash has been compared to the 1980s bust, the worst in Houston’s history. Between 1982 and 1986, Houston shed over 220,000 jobs, which would be the equivalent of losing more than half a million jobs today over an adjusted base. The difference during this past downturn is that Houston only shed a couple thousand jobs net, while continuing to lead the nation in population growth through the downturn. Moreover, during the 1980s, an oil downturn was compounded by a Savings & Loan crisis.

During this most recent oil downturn, Houston benefited from a strong U.S. economy as well as an increasingly diverse local economy. The energy market has begun to regain its footing, although with new realities. The days of rig counts regularly exceeding 1,700 nationally and crude oil prices eclipsing $100/barrel are not likely to return soon. The consensus of many energy industry experts is that cautious growth in the energy industry is the new norm. They forecast a more sustainable, Goldilocks recovery—in essence, not too hot and not too cold—less volatile.

Since the 1980s, Houston has diversified both within the energy industry—across upstream, midstream and downstream—and outside of it. Professional and Business Services and a variety of other industries expanded their geographic reach and stature and grew in tandem alongside Houston’s population growth. Houston has become a central location for top medical research facilities and cutting-edge technological advances. The Texas Medical Center (TMC) is a major economic driver, employing over 100,000 people—second only to downtown Houston’s approximately 150,000—and that number continues to grow. There are more than 175,000 high-tech professionals working in the combined knowledge cluster of the TMC, Rice University and the University of Houston.

The Texas Medical Center 3 (TMC|3) project is symbolic of the local health care industry’s meteoric trajectory. The TMC|3 is a proposed $1.5 billion collaborative research campus that will foster a commercial biotech hub, formed as a partnership between TMC, Baylor College of Medicine, Texas A&M University Health Science Center, The University of Texas Health Science Center at Houston and The University of Texas MD Anderson Cancer Center. Expected to break ground in 2019, the campus will be located just south of the existing TMC. Upon completion in 2022, it is estimated that TMC|3 will drive over $5 billion into the Houston economy and create 30,000 jobs.

Well known for recovery and longevity, Houston’s office market and economy are doing well in the face of its challenges such as recovering from Harvey’s wake. We are corporate experts in Texas markets and hope you will look to us for any additional information regarding this information or properties. Please contact me.

Information based on CoStar Market Reports