Per Insurance Journal, the outlook for the U.S. property/casualty commercial insurance sector remains stable given healthy core earnings and sound balance sheets reported by investors.

“Commercial insurers held up well despite the large catastrophes of 2017 and will generate good core earnings in 2018-19,” says Bruce Ballentine, vice president and senior credit officer at Moody’s Investment Service. “Insurers will benefit from higher rates in property lines and stable-to-rising investment yields, tempered by slightly worse combined ratios in casualty lines.”

Moody’s analysts describe a positive picture for the upcoming year: Commercial lines pricing is more favorable than in recent years. Property rates are higher following the 2017 catastrophes, although the rating agency expects renewed downward pressure by 2019 absent further catastrophes. Casualty rates are trending slightly upward in aggregate, with high-single-digit increases in commercial auto and modest declines in workers’ compensation.

As a backdrop for the sector outlook, Moody’s forecasts that U.S. real GDP growth will peak at 2.9 percent in 2018, declining to 2.3 percent in 2019 and hovering around 2 percent for the next couple of years. Nevertheless, says Moody’s, the expanding U.S. and global economies will drive growth in insured exposures and related commercial lines premiums. Insurers’ loss reserves are deficient in commercial auto, moderately redundant in workers’ compensation and other lines, and adequate overall, with little cushion relative to Moody’s loss estimates.

Through Moody’s forecasting, Insurance Journalalso expects that insurers will continue to invest in data and analytics, robotic automation, mobile solutions and other technologies and that they will harness technology to better engage with customers, develop new products, operate more efficiently and manage risks.

More on some of the items insurers are looking to trend in 2019 follows per CB Insights.

WORKPLACE WEARABLES & TRACKERS

WORKPLACE WEARABLES & TRACKERS

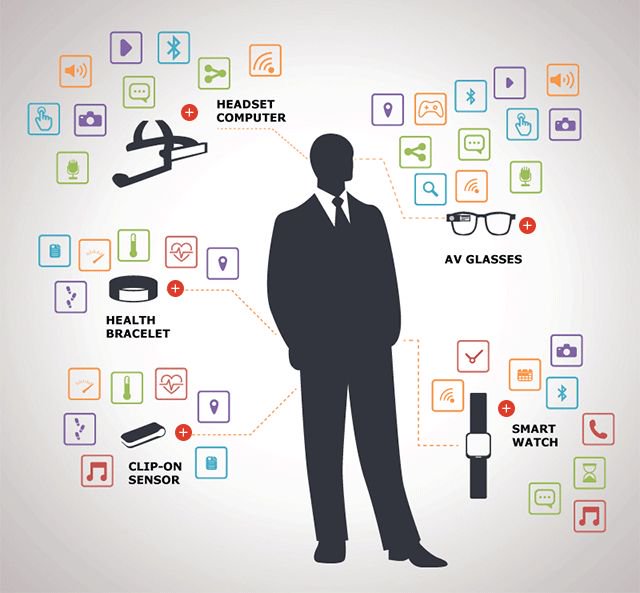

The use of wearables and sensors to prevent workplace injury is gaining traction in the workers’ comp space. Workers’ compensation insurance, a $53B market in the U.S. features one of the longest tails between premiums and liabilities, as workers who suffer a work injury can sometimes take years to return to work.

Wearable sensors not only helps improve worker safety in some of the riskiest work environments (such as construction), they can also reduce costs by providing worker health data, according to research from University of Michigan professor SangHyun Lee.

Lee’s research focuses on how advanced signal processing and machine learning techniques can derive useful information from wearables, including identifying stress, physical demands, and risk perception levels.

According to the International Labor Organization, ~6,300 people die every day in work-related accidents or illnesses, which is more than 2.3M deaths each year. On The Hartford’s last earnings call, president Doug Elliot noted that low unemployment rate and longer work hours have compounded the risk of workplace injury.

Ultimately, other frictionless technologies may also enter the workers’ comp market. SafetyCulture, for example, provides a mobile inspection reporting app called iAuditor to more than 15,000 organizations. Companies can use the app to create checklists, conduct on-site inspections and analyze data in real time. Eventually, SafetyCulture’s data could be used to develop risk profiles for workers’ comp insurance based on its datasets about its clients’ quality and safety records.

Ultimately, other frictionless technologies may also enter the workers’ comp market. SafetyCulture, for example, provides a mobile inspection reporting app called iAuditor to more than 15,000 organizations. Companies can use the app to create checklists, conduct on-site inspections and analyze data in real time. Eventually, SafetyCulture’s data could be used to develop risk profiles for workers’ comp insurance based on its datasets about its clients’ quality and safety records.

CYBER RISK ANALYTICS

CB Insights states that cyber risk analytics providers will need to prove they can enhance underwriting performance as the cyber insurance market evolves.

Cyber insurance growth could be driven by the affirmation of potential cyber exposures within traditional P&C policies, as well as businesses increasingly understanding potential insecurities as connected machinery and vehicles gain traction. But while growth estimates are positive to more than double next year from 2017, the total number of cyber insurance writers today is still small.

At Berkshire Hathaway’s annual meeting this year, Warren Buffett said, “I don’t think we or anybody else really knows what they’re doing when writing cyber. We don’t want to be a pioneer on this.” In order for growth to continue, P&C insurers are starting to turn to technology tools to justify and sustain cyber risk analytics positions among insurers.

COMMERCIAL DATA AUGMENTATION

Insurers are using public data, such as social media, to verify claims and enhance underwriting processes. The growth of publicly available data – and software to collect that data – has given rise to new tech solutions for P&C insurers.

Per CB Insights, commercial data augmentation solutions could help reduce the time for business owners to complete commercial applications and for underwriters to verify information. Emerging players are using data pre-fill, validation, and qualification solutions, though many efforts are still early in overall impact.

Data augmentation could also help combat fraud. Allstate partnered with Carpe Data in 2017 to help spot fraud by using social media and other content to validate claims, thereby reducing investigation costs. More businesses will be watching and participating as commercial data augmentation tools continue integrating new and relevant data sources.

![]()

COMMERCIAL AUTO TELEMATICS

A mandate for commercial truckers to install electronic logging devices could help drive adoption of new telematics products. While many fleet operators have already adopted telematics to help understand driving behavior and vehicle ownership costs, the use of telematics by commercial auto insurers is still nascent.

Telematics for commercial auto insurance has several key benefits, including automatically notifying insurers about accidents and bolstering safe driving habits. Regulatory mandates could also be a tailwind. The federal government mandated by December 2017 that commercial truckers install electronic logging devices (ELD) to log the hours that a commercial truck driver is driving, resting, and on-duty but not driving.

Some insurers are hoping this ELD mandate will catalyze new products. In September 2018, Progressive launched a new product called Smart Haul, which gives customers savings on their commercial auto policy if they qualify with certain safe driving metrics. Smart Haul uses data obtained by ELD devices and does not require drivers to install a new device or reconfigure their existing device.

While driver privacy concerns present a challenge, the potential for expense reductions combined with the growing use of ELD devices and telematics driving histories should result in more activity by commercial auto insurers.

HYPERLOCAL WEATHER ANALYTICS

HYPERLOCAL WEATHER ANALYTICS

Hyperlocal weather and climate data and analytics could improve underwriting and insurance pricing. Companies are seeking better climate and weather forecasts to assess the risks of operating in various locales.

One of the new technologies in this area is using ground sensors to collect granular weather. They are already being used to record hailstone impacts and wind gusts to better manage hail events. Other companies are analyzing signals from wireless and cable networks to create micro-weather forecasts. While these climate risk analytics tools are still new, insurers appear open to the possibility of augmenting existing approaches with new technologies.

COMMERCIAL DATA AUTOMATION

According to CB Insights, insurers are starting to unlock the value of unstructured and semistructured data. Within the commercial P&C industry today, massive amounts of data comprising submissions, loss runs, exposure schedules, and policies remain tied up in unstructured or semi-structured documents – from PDFs and Excel files to scanned images and emails.

Unlocking that data presents real opportunity for insurers, reinsurers and brokers across a number of transactional and analytical use cases. These range from improving underwriting efficiency and automating submission data capture, to identifying underwriting profit pools and marketwide changes in loss exposure.

Improvements in natural language processing technology are driving commercial data automation, and help justify the economics for insurers to invest for potential growth and upside. For brokers, commercial data automation software provides an opportunity to gain better insight into where they are generating underwriting profits.

CONVERSATIONAL Al

CONVERSATIONAL Al

We mention the chatbots last in this series, as in insurance they could be more hype than substance. While chatbots have been the butt of recent jokes on certain insurance commercials, a number of insurers are leveraging conversational Al – computer programs that simulate human conversation through voice commands or text chats – to drive customer engagement. Some insurers are using this technology to let clients share details and visual information in real time, allowing both sides to communicate more efficiently.

According to CB Insights, the hype around chatbot technologies appears to have peaked last year, with the number of news mentions hitting a monthly high in August 2017. While insurers continue to implement new chatbots, some financial institutions have seen lackluster engagement results. As such, the overall market opportunity for conversational Al in insurance may prove to be short-lived.